Investment Performance Measurement

What is Investment Performance?

The rationale underlying the performance measurement process can best be summarized by the following anonymous quote: “You can’t know where you’re going until you know where you’ve been.”

Active investment managers must understand the “what, why, and how” of their past performance in order to effectively manage their current clients’ portfolios. Performance Measurement should be an integral part of the investment decision-making process, instead of external to it.

What is an Investment Performance Manager?

When people ask, ‘What do you do for a living?’, I best describe the role of a Investement Performance Manager:

“So, do you have any investments, and do you get a statement that shows a % figure on it? Well, that is called a Rate of Return, and I calculate those across all investment products that a firm might have. I’m not an Investment Analyst, for those types of people predict what an Account or specific Investment ‘could do’, for they are for Analysts predict what they hope to happen. I, on the other hand, tell you what that Account or Investment did, after the fact.”

The inherent qualities of an Investement Performance Manager requires one to be very detailed, methodical and extremely organized. As Performance Platforms calculate returns in the same manner, it becomes a matter of detailing out the Inputs that are needed so as to ensure proper calculation of the Outputs.

Investment Performance Specialist - primary functions:

Investment Performance Manager Characteristics

Any Investment Performance Manager will tell you that a Performance Manager involves becoming a ‘forensic expert’ in that it is his/her job to determine what part of the Operational process ‘broke’ that caused the erroneous performance return. All Portfolio Accounting Systems calculate the returns in basically the same way, but it’s a) the accuracy and b) the order of the inputs that determine the proper calculation of your performance returns. If somewhere along the chain an input was inputted incorrectly, or an input was processed in the wrong order, it is up to the Performance Manager to determine the root of the error.

Delivers and oversees delivery of accurate performance analysis, reports and technical requests and verify accuracy of all portfolio and benchmark performance results

Research and resolve complex performance issues using strong analytical skills with high attention to detail and accuracy

Review performance calculation methodologies, researching and updating as required

Collect data and analyze investment performance results for use in developing reports for external clients or internal users

Knowledge and understanding of a variety brokerage systems or applications with a comprehensive knowledge and understanding of broker-dealer channel

Ensure accurate and timely distribution of GIPS composite performance along with total return investment performance and risk measures for portfolios and benchmarks

Provide support to marketing area by responding to clients and consultants routine ad-hoc performance inquires and/or RFP/consultant questionnaires

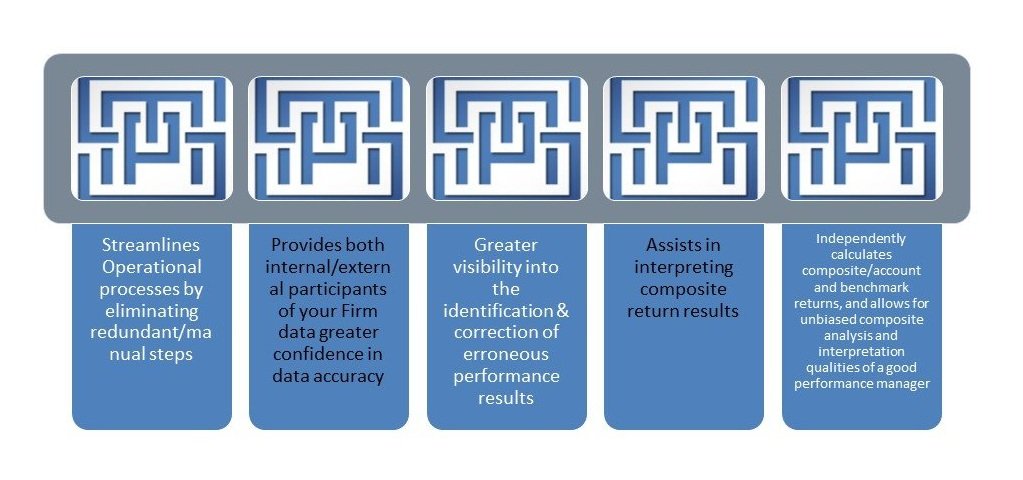

Dedicated Investement Performance Manager Benefits

Some firms do not have an internal Investment Performance Manager as a part of their organizational structure. In all of my years of experience these types of organizational structures do not work efficiently and effectively for there is no one person responsible for the Investement Performance data. Without an overarching Performance Manager to be responsible for all aspects of firm-wide performance reporting, the firm puts itself at a disadvantage, as well as at an operational risk. Some Firms feel that having a dedicated resource for reporting is unnecessary. We disagree with that assumption because Investement Performance Managers implement the following benefits:

Investment Performance Manager Consultant Services

Every investment management firm performs the same functions, just in slightly different ways, utilizing different platforms, methods, etc. Ultimately, the processes might be different but the end results are the same. Having worked in Operational environments for 20+ years, I have experience in a majority of the Operational processes investment management firms perform on a day-to-day basis.

I can utilize our years of industry knowledge on a short/long-term basis to help suit your firms needs.

Below are just a few examples of the knowledge & expertise Performance Measurement Solutions can implement at your firm through Investment Performance Consultant services:

Implementing Composite Management Software

If your firm is small, with just a handfull of accounts, spreadsheets can be a cost-effective way of maintaining your composite data. However, spreadsheets are prone to errors, are not recommended, and my first suggestion would be to implement a composite management software system. Inherent efficiencies, as well as enhanced data accuracy is gained by using a composite management software program to construct, calculate and maintain your composites.

I have helped many firms convert off of spreadsheets into a composite management software system. And, even start from scratch! There are a variety of systems that are available, and I here to help you find and implement the right system for your firm.

Firm-Wide Reporting

All firms report their numbers to outside consultants, databases, clients, websites, etc. These figures come in the form of Assets Under Management, Client Statements, Composite Returns, Holdings & Characteristics. Firm-wide reporting should be accurate and consistent across all platforms.

We can assist firms in developing mechanisms to mitigate risk regarding the reporting of incorrect information to data participants outside of the firm. Some of the measures we have implemented in the past are shown below.

Benchmark Validation

Many firms receive the same benchmark data from multiple sources. However, what firms do not always know is that returns from these sources might be slightly different due to a) decimal point rounding over time b) preliminary vs finalized returns and/or c) the vendor accidentally publishing incorrect figures. We implement safeguards at firms to cross-check benchmark information against all sources to ensure consistent reporting across all channels.

Reporting Deadlines

Typically, firms report the same pieces of information on a monthly, quarterly and yearly basis. Some of these pieces of information are needed to ‘feed’ into other pieces of data, like Quarterly Fact Sheets. We assess the deadlines needed across all reporting requirements to ensure that a) all deadlines are met and b) accurate information is consistently presented across all published materials.

Data Reconciliations

Cross checking (or reconciliations) are a good measure to implement in regards to firm-wide reporting capacities to help mitigate the risk of errors. A good example of such a situation is reconciling your firm’s Composite Assets Under Management to your Firm’s Overall Assets Under Management. Reconciling these 2 figures, at both the market value and # of accounts level, is an extremely effective way to ensure that all assets are accurately captured.

Performance Manager Checklist

This Checklist was created from multiple client checklists over time, and is not an all-inclusive list of every function that exists at your firm. However, this checklist can provide you with a working framework to facilitate the organization that is needed around the Performance Manager function. Once utilized, this Checklist format can be utilized for monthly, quarterly and even yearly processes.

Sample Client Engagement

Firm A was in the midst of an entire system-wide portfolio, performance, trading & composite system conversion. After getting 75% through the project, Firm A realized that the new portfolio accounting system was not calculating the same performance returns as the legacy system. Firm A did not have a Performance Manager on staff, and needed help, immediately. I was able to jump into the situation, and get up to speed relatively quickly, to assist Firm A with identifying the performance issues, and assist Firm A with the remainder of the conversion project. All the while, I developed all of the new performance-related processes for the new system, transitioning out of the old processes to entirely new processes.

Assets Under Management: $5B

Account Types: Brokerage accounts, wrap programs, mutual funds and institutionally managed accounts

Investment Vehicles: US Equity and Fixed Income investments

Accounts Under Management: 3500+

Major Hudle: Jumping head first into a project that had been running for over a year, with data already being converted.

Case Studies

During my 25+ years in the investment management industry, I have written up some illustrations of challenges posed to Firms, along with some other noteworthy observations. Some of these write-ups are listed below.

Time vs money weighted returns

When should a firm use MWR vs TWR in reporting investment management performance to its clients?

Performance Manager Job Description

Criteria of job functions, along with the skill requirements needed to become an effective Performance Manager.

HYpothetical Performance

Multiple types of hypothetical performance exist including Back-Tested, Model and Projected.

Quality control

How to ensure and maintain the quality of your investment performance results.

Asset Class Breaks

How to determine Strategic vs Tactical investing strategies, for breaks in performance returns?

CLO - Collateralized Loan Obligations

This page provides a brief description of this investment structure, and key terminology concepts.

(IBOR) Investment Book of Record

The role of an Investment Book of Record (IBOR) in investment management and operations as it relates to Performance.

Risk measures and statistics

Quick reference guide defines some of the most commonly used investment performance terms.